Accounts Production

Experience the power of automation and increase your accuracy and efficiency with compliant statutory reporting.

Request a demo

Fast, accurate and compliant year end accounts

Most year end accounts are too complex for paper-based, manual processes and require digital tools to automate the processes. With Caseware, you can quickly and efficiently produce your year end accounts across a wide range of entity types, no matter how complex your accounting is. Automate the production of your IFRS, FRS 101, 102 and 105 accounts to enable your teams to take on additional client work.

Simplify your accounting across our specialist templates for academies, charities, pensions, LLPs, IFRS and group consolidations.

Features

Integrated step by step guidance that increases accuracy and efficiency

The in-built wizard lets you simply follow processes throughout the accounts production journey. Import your trial balance, bring in company details directly from Companies House and then tailor your accounts effortlessly.

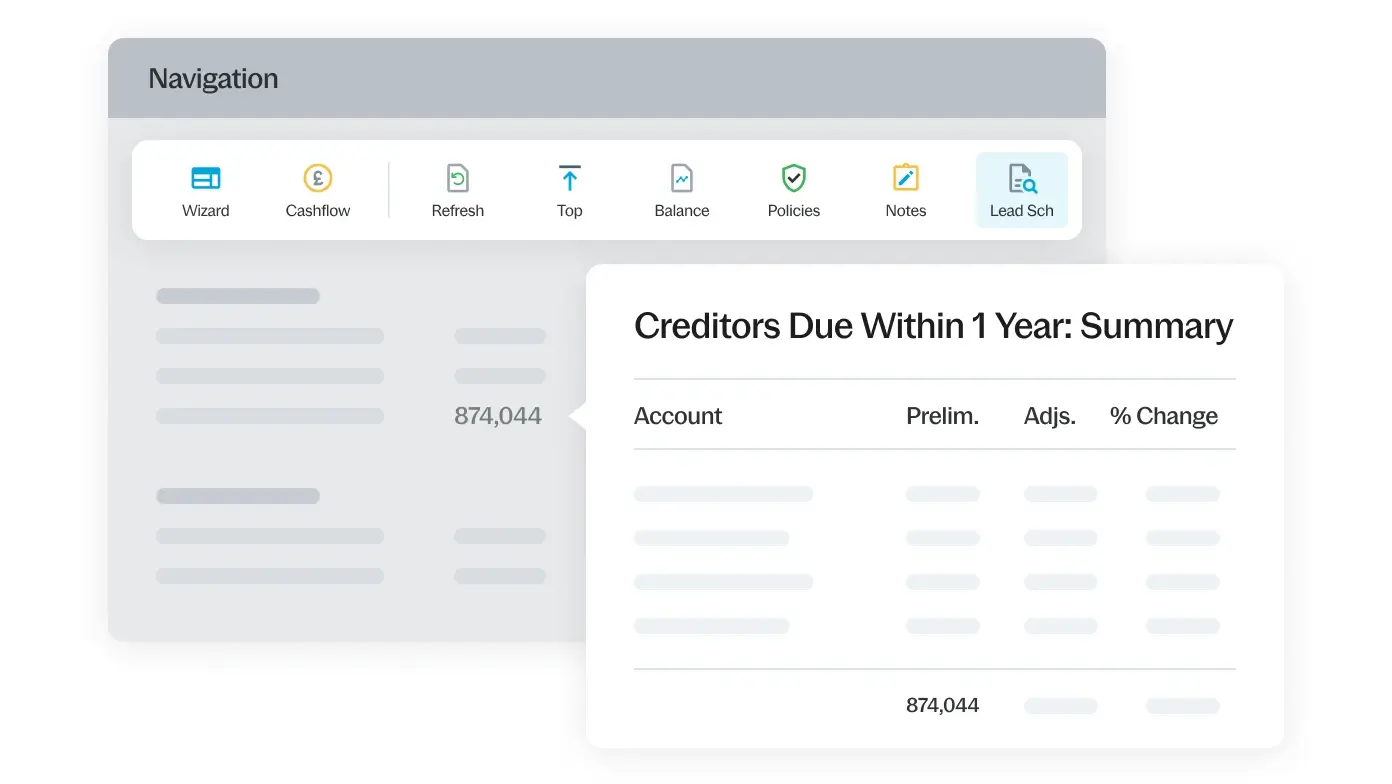

Have confidence in your accounts with drilldown and analysis

Drilldown on any figure on the face of the accounts to automated lead schedules allowing you to add notations or supporting evidence such as spreadsheets and PDFs within a couple of clicks.

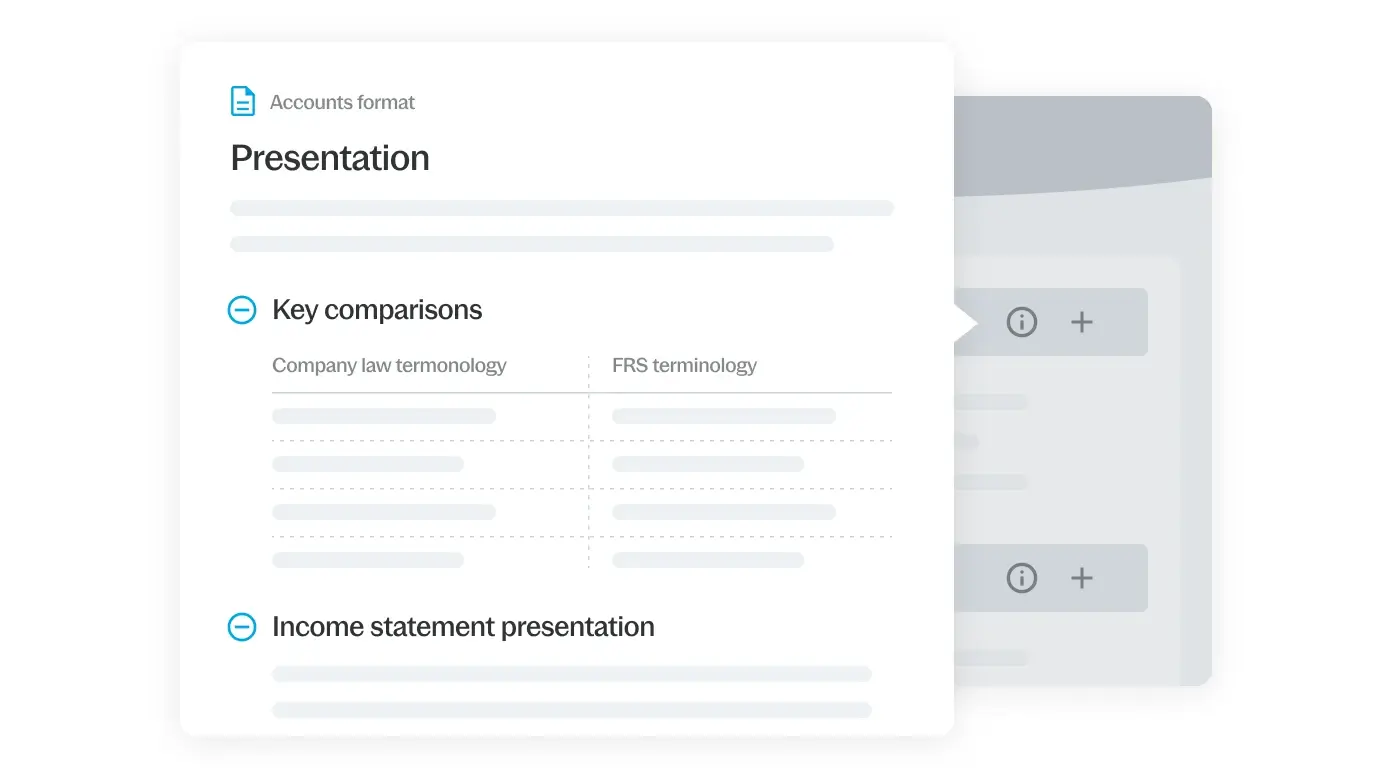

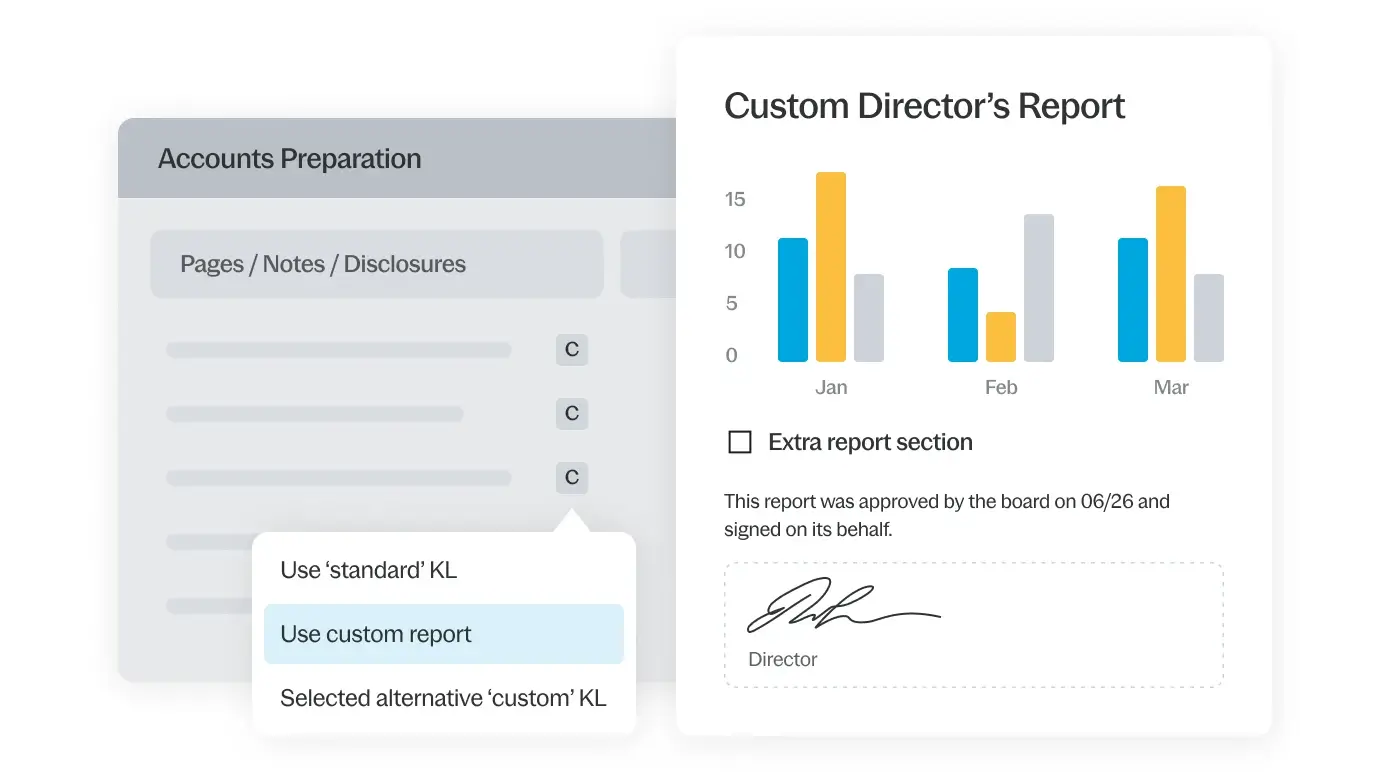

Enhanced control with customisation

Our customisation and notebuilding tools allow you to tailor your disclosures to include the exact level of detail that you specifically require, giving you full control over the accounts.

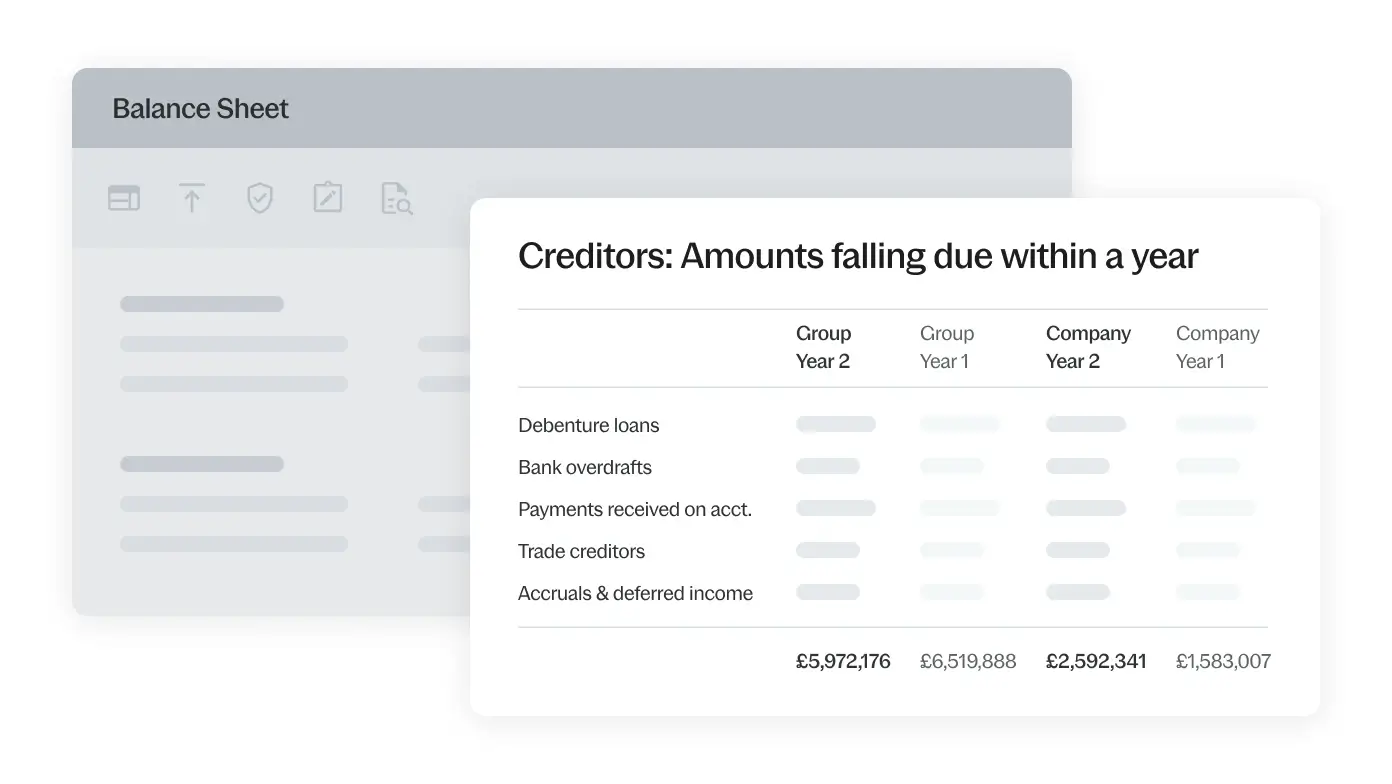

Easily see the bigger picture with group consolidation

Reduce reporting time by easily consolidating multiple sets of accounts in one engagement file giving investors, regulators and customers a better overview of the entire entity’s overall financial health.

Benefits

Boost staff efficiency and experience

Comply with confidence

Work together – from anywhere

Increase your reporting accuracy

Easy review

Automated iXBRL tagging

Supporting tools

Easy-to-use templates that simplifies the financial reporting process

Take advantage of carefully crafted templates designed to simplify the lives of accountants

-

Corporation Tax

arrow_forwardLeverage capability and integration and automate the process of producing corporation tax computations and filing CT600. Enhance your efficiency at every stage of your tax process and calculate, analyse, produce, tag and submit online in one easy process.

-

Caseware IDEA

arrow_forwardCaseware IDEA data analysis software seamlessly integrates with Caseware Working Papers and Caseware Cloud to offer a one-stop, easy-to-use solution for external auditors, accountants and data analysts.

Moduless to help financial professionals be collaborative

Enhance communications with our intelligent cloud tools

-

SmartSync

arrow_forwardProvide everyone on your team with up-to-date changes to working papers, eliminating the need to manage synchronisation. Team members collaborate on local copies of a client file in real time, with each automated Working Papers file syncing in the background.

-

CloudBridge

arrow_forwardSeamlessly transfer data from Caseware Working Papers to a cloud engagement. To import data to a cloud engagement, begin by downloading the installation package and install the version of CloudBridge for your region.

-

Connector

arrow_forwardEasily access and retrieve a wide range of data, including trial balance data, engagement properties and firm properties, while seamlessly inserting it into a Microsoft Excel file.

Find the answers you need

There are multiple sign off levels but typically you would have a prepared by and a reviewed by for each document. You can sign off entire folders in one click which is useful when reviewing an entire audit section – such as Stock for example. If there are any review points, these can be raised by way of “Issues”.

SmartSync is a good way to enable users in different locations to work together. It is also possible to send batches of files from an engagement to another user via email quickly and easily. However, we do find collaboration via the Cloud to be the preferred method these days.

Yes. This requires an additional module, but once purchased, you can tag and submit your Accounts electronically – saving you time and money.

All of our standard content will be fully tagged to the relevant taxonomies for UK and Irish entities. Where our standard content is amended, users can easily amend the default tag and similarly, any new content can be tagged manually to whichever taxonomy is applicable. A helpful “traffic light” review tool shows which parts of the accounts are tagged to a CaseWare standard tag (green), an amended tag (orange), or a new user-created tag (yellow). If any tags are omitted, they will show up in red.

This is achieved by either combining multiple single entity engagement files within CaseWare – or you can add multiple entities within one file and effectively use several TB’s for each entity in the one engagement file. Eliminating journals are likely to be required, but these can be entered by selecting the applicable entity available from a drop-down selector within the journal entry screen. This option is only available when you do have more than one entity – so you would not see this additional column within a single entity engagement.